Work That Sets Us Apart

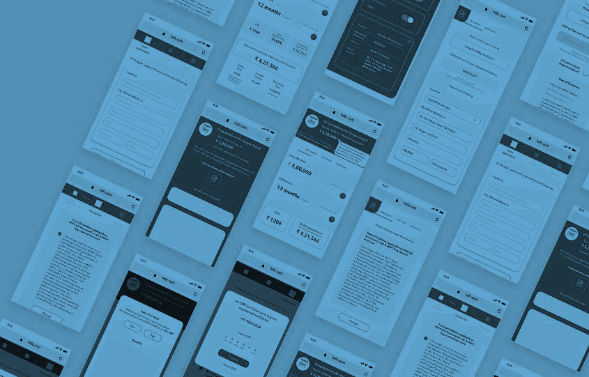

Loan in 10 seconds! India’s first digital loan disbursal application

The Opportunity

To gain a competitive advantage by creating an easier way to disburse personal loans.

The Human Lens

HDFC Bank has always been a technologically progressive bank. Since loans formed a major chunk of their revenue, the client wanted to create a digitally-empowered way to disburse loans to existing to bank customer, which would keep them a step ahead of the competition. One of the biggest obstacles that hinder loan disbursement is the amount of time the entire process takes. This, we realised, is what we needed to change completely in order to deliver the desired output.

How We Shaped Behaviour

We devised a first-of-its-kind ’10-second Loan Disbursal’ service wherein eligible existing to bank customers received their personal loan offers. This was made possible by creating an API using .Net technology that directly consumed data from the bank’s core systems. This meant that the customers only had to submit their pre-filled application form, accept the offer in the up to the proposed limit and that was it! The success of this service enabled us to scale it up to include topping-up of personal loans as well as digital disbursement for auto and two-wheeler categories, expanded to new and used vehicles.

The Success Story

A post campaign brand study revealed that we achieved:

- Zero media spends Journey hosted on bank’s net–banking platform.

- Scaled up To include other loan products

Indigo Consulting

Indigo Consulting @indigo_cons

@indigo_cons Indigo.consutling

Indigo.consutling Indigo Consulting

Indigo Consulting